One of the common questions that every stock investor faces is “How many stocks he should own in his portfolio?” How many stocks are too few and how many stocks become too many? Too few stocks expose the investor to high risk that under-performance by a single stock would significantly bring down the value of entire portfolio. Too many stocks would spread the portfolio very thin and stellar performance by any stock would have only minimal impact on overall portfolio.

Many investors follow different approaches for it. Some investors believe in linking the number of stocks to the size of the portfolio. Others link it to the number of investment opportunities available. Still others link it to the age of the investor. There is no consensus on any way of determining the ideal number of stocks in a portfolio.

This article aims to help the investor through this riddle and arrive at the ideal number of stocks in his portfolio.

It is well known that increasing the number of stocks in the portfolio increases the diversification, which effectively reduces the risk in the portfolio. Diversification means that different stocks of the portfolio respond to different factors and all of the stocks do not go down in value at the same time; thereby reducing the probability of severe losses during bear phases. However, there are certain established rules of diversification, which act as guidelines to solve the puzzle of ideal number of stocks in the portfolio:

Guideline No. 1: The minimum number of stocks in the portfolio: Two (2)

Example: – Husband and wife.

After marriage there is an increase in family member, our responsibilities, as we need to take care of our partner’s dreams and wishes .Whenever we do investment in stock market we should follow one simple thing i.e add company to our portfolio equal to our family members .Lets say ,if your family consists of 2 members then add atleast 2 company in your portfolio so it will be easier for you to monitor the track records, business , income of company , business model , EPS , P/E , Daily price movement , etc

Two stocks from different industries is the minimum number of stocks that any investor should have in his portfolio, to get any diversification benefit to reduce risk.

It is believed that more the number of stocks in the portfolio, the higher is the diversification benefit or lower is the risk. However, the rules of diversification limit further benefit after reaching a certain number of stocks in the portfolio, which becomes the maximum number of stocks in the portfolio.

Guideline No. 2: The maximum number of stocks in the portfolio: (10)

Different researchers have proved that the additional diversification benefit, which increases with addition of a new stock in the portfolio, becomes minimal after 10 stocks.

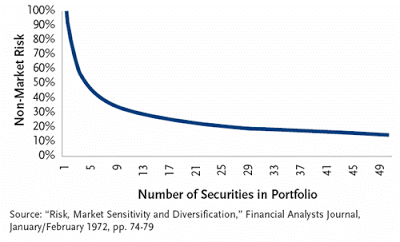

The above graph from Financial Analysts Journal, indicates that if an investor adds more stocks in the portfolio beyond 30 stocks, it would not reduce any further risk in the portfolio. On the contrary, it would make the portfolio unnecessarily large and the good performance of any one stock would not be able to produce meaning impact on the total portfolio performance. Therefore, increasing the number of stocks beyond 10might prove counterproductive for the investor.

It is, therefore, recommended that an investor should keep the number of stocks in his portfolio within these two boundaries of 2 and 10.

However, another very important factor limits the number of stocks an investor should have in his portfolio:

Guideline No. 3: Effort & time spent in monitoring:

Every stock in the portfolio requires regular monitoring by the investor. It is a mix of continuous monitoring, quarterly monitoring and annual monitoring, as detailed in the following article:

Reading the above article would help an investor develop his monitoring framework and estimate the amount of effort it would take to monitor each stock in his portfolio. Monitoring every stock would entail detailed reading of at least four quarterly statements and one annual report every year, in addition to regular reading to news and updates about the company (e.g. Google alerts).

The investor should have only as many stocks that he can monitor effectively given the time & effort, which he can spare for his portfolio. Inability to monitor and staying updated about his stocks regularly might present his with surprise developments related to his portfolio stocks and increase the risk.

Guideline No. 4: Have the minimum possible number of stocks:

The above guidelines suggest that an investor should try to own as few stocks between 2 and 10, as possible. Having minimum possible number of stocks, if monitored effectively, would provide a healthy mix of diversification benefit without spreading the portfolio too thin and without putting huge demand on investor’s time.

The legendary investor, Warren Buffett also believes in having minimum number of stocks in the portfolio. He advised investor to have concentrated holdings in his 1978 letter to Berkshire Hathaway shareholders:

“Our policy is to concentrate holdings. We try to avoid buying a little of this or that when we are only lukewarm about the business or its price. When we are convinced as to attractiveness, we believe in buying worthwhile amounts.”

Additionally, during times of crisis/recessions, diversification seems to have failed to provide any real benefit. Investors would remember that during the market decline of 2008, almost all the stocks irrespective of the industry they belonged to, fell in tandem. This hard lesson was learnt earlier in 1998, during Russia, Brazil and East Asia Crisis, when a prominent hedge fund, Long Term Capital Management, witnessed its more than 6,500 investment making losses simultaneously. The fund had to be bailed out by others.

Therefore, the attempt of an investor should be to own the minimum possible number of stocks, as per his convenience, comfort and availability of spare time.

I suggest the investor to diversify the portfolio as much that she should not lose his peace of mind by being overly concerned about it. If owning 100 stocks makes his feel comfortable, then he should have it. However, this article is aimed at conveying the message that the diversification benefit of 10 or 20 stocks is almost the same. On the contrary, larger number of stocks would hurt portfolio performance, as any good performing stock would be able to have only a small impact on the overall portfolio returns.

Steps for building a portfolio with ideal number of stocks

An investor should take following steps to build the personalized portfolio ideal for an investor:

Step 1: Always, first look for opportunities in the existing stocks in the portfolio.

It is assumed that the investor has bought his existing stocks after doing detailed research and has monitored performance of these companies over the years. Therefore, he knows these stocks more than other stocks in the market. If any of the stocks in the portfolio provides good investment opportunity, than the investor should prefer investing in it rather than searching for a new stock every time he has surplus money.

However, if an investor realizes that he has bought his stocks based on recommendations of others and has not done his own research, then he should scrutinize his portfolio stocks on the steps mentioned in following articles to decide whether his portfolio stocks pass the test of being investment worth.

Step 2: Sell those stocks of the portfolio, which do not pass the test:

An investor should sell the stocks, which are showing deteriorating operating performance for at least two consecutive years. Selling these stocks would purge the portfolio of undesired stocks and lead to a neat & clean portfolio with fundamentally good stocks.

He may follow the guidelines mentioned in the following article to find out stocks to sell from his portfolio, so that he is left with good stock.

Step 3: Add any new stock only when not able to find any investable stock in the existing portfolio.

When the investor realizes that all the stocks in his portfolio are fundamentally sound and have crossed the threshold of putting additional money, then he should start the search of finding a new stock to be added to his portfolio. He should always keep in mind that addition of every new stock is going to add to the time & effort required to monitor the portfolio effectively. Therefore, he should always try to keep the number of stocks in the portfolio to the minimum possible.

The ideal number of stocks in the portfolio would vary from one investor to another. We can see that the major factors, which would determine the number of stocks, are:

Number of stocks should be between 2 to 10. Portfolios having any number of stocks more than 10, do not offer any additional benefit in terms of risk reduction than the portfolio with 10 stocks.

Number of stocks would depend upon the time & effort the investor can spend on effectively monitoring the stocks in the portfolio. A full time investor can afford to have more stocks in his portfolio than the investor having another full time day job.

An experienced investor can afford to have more stocks in his portfolio as he can monitor his stocks effectively by spending less time than a new investor. It is assumed that a new investor would need more time to understand the quarterly & annual reports and thus might not effectively monitor a large portfolio until he gains the required expertise.

Once the new investor feels comfortable with his monitoring framework, then he can enlarge his portfolio without diluting the monitoring quality.

Number of stocks in the portfolio of a new investor

The argument above might go against the common perception that new investors should have a large portfolio, as they might err while selecting portfolio stocks and a large portfolio would minimize the impacts of their errors. Followers of this argument believe that a large portfolio would have a greater chance of hitting a jackpot. However, I do not recommend that a new investor should have a large portfolio of stocks.

A new investor should spend more & more time honing his skills of stock selection and monitoring. Therefore, he should focus on a few stocks at a time. If he has more surplus money, then he should invest it in equity mutual funds temporarily, which would shield his portfolio from his stock selection mistakes in the initial phase. Once he believes that he has learned the art of stock selection & monitoring, and then he can shift his savings from mutual funds to his carefully selected stocks.

Therefore, new investors should try to keep their portfolio size small so that they can focus more on the learning aspect of stock investing and learn the higher levels of this skill.

Conclusion

Therefore, we can see that it is good for any investor to have the minimum number of stocks between 2 to 10 in his portfolio. The number of stocks in the portfolio is a fine balance between the peace of mind from sudden decrease in portfolio value due to any stock doing poor and the time & effort needed to monitor the portfolio effectively.

Therefore, the ideal number of stocks in the portfolio is an outcome of the investor’s risk appetite, his investing expertise and the time availability with his.

Currently, I have six stocks in my portfolio and feel comfortable about investing additional amounts in the existing stocks until the time I am able to spot investing opportunities within the portfolio. It would be great to have your feedback on the following aspects about your portfolio:

How many stocks do you have in your portfolio?

Do you feel comfortable and feel the peace of mind from sudden drop in their value, with the existing number of stocks in the portfolio?

How has the number of stocks in your portfolio changed, as you became a more matured investor? Has the number of stocks increased or decreased? ( Sources :- Dr Vijay Malik )

You must be logged in to post a comment.